DIN Network

Block

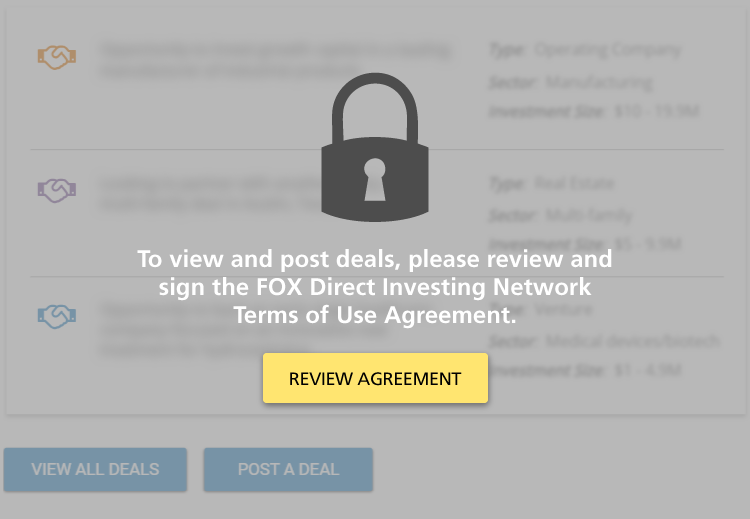

The Direct Investing Network is for families actively engaged in direct investing who want to share information, deals, and experiences with other active investors.

Terms of Use

Block

Block

DIN Network Sponsorship

Contact Tim to learn about sponsorship opportunities.

Block

Investment Deals

We have invested in Treaty Oak Brands, producers of Treaty Oak Whiskey and Waterloo Gin, headquartered on a popular ranch a few miles outside Austin, Texas, and winners of numerous international awards. The two brands are supported by the capital,…

Sector: Operating company, Food & Beverage

Investment Size: $1 - 4.9M

Inclenberg Investments is seeking LP co-investors to invest in an industrial real estate development near the Port of Houston in Pasadena, TX. Inclenberg has partnered with Provident Realty Advisors, an experienced national developer, to develop a…

Sector: Real Estate

Investment Size: $1 - 4.9M

Brixton Capital has been awarded the acquisition of the Alta Warehouse apartment complex in Phoenix, AZ for $82 million / 273K per door / $290 PSF.

Alta Warehouse is a 300-unit, 4-story, elevator-served apartment community in the…

Sector: Real Estate

Investment Size: $30 - 39.9M

We are acquiring a first-class apartment community in Lakewood, Colorado, called the Windsor (the "Property") directly from the seller in an off-market transaction. The purchase price is $125 million ($320 PSF), representing a 5.67% cap…

Sector: Real Estate

Investment Size: $1 - 4.9M

LCI Development Partners is seeking a $9MM limited partner equity investment to construct a 70-unit boutique luxury multifamily project within walking distance to local grocers, restaurants, and other area amenities.

The project is located in the…

Sector: Real Estate

Investment Size: $5 - 9.9M

Please see below SpaceX opportunity for Family Office Exchange members.

SpaceX will be running a Tender Offer at year end, which occurs every 6 months for employees. The shares are classified as common. There is no difference between Tender and…

Sector: Venture Capital

Investment Size: $50M+

We’re excited to announce that in June of 2020 we plan to launch our anchor immersive gaming and entertainment company location at Chicago’s Navy Pier. Our immersive gaming and entertainment company is a Chicago-based entertainment company…

Sector: Venture Capital

Investment Size: $5 - 9.9M

AgNovos Bioscience - A Regenerative Technology Company, Pioneering Novel Treatments for Bone Disease

We are raising up to $60mm of funding at a $300mm pre-money valuation in a Series B Preferred Stock. The goal for the company to have an IPO in late 2026. The family has invested over $200mm into this company and will be investing in the…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $50M+

Seeking $2 to 17 million for investment in Series F financing of the one of the largest legalized sports betting company in the US. The financing is being lead by a prominent investment firm.

As an indirect founding investor in the company, our…

Sector: Venture Capital

Investment Size: $1 - 4.9M

The Springs Living and its development partner, PMB LLC, are excited about the development plan on the Columbia River waterfront in Vancouver, WA. The project includes 250 IL/AL/MC senior housing units within the Waterfront Master Development, which…

Sector: Real Estate

Investment Size: $10 - 19.9M

UK-based medical diagnostic company with a unique screening technology for the detection of drugs of abuse using the sweat of a fingerprint. Non-invasive sample collection takes less than a minute, and results are obtained at the point of care in…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $1 - 4.9M

Cavan Companies is the lead investor-developer of 210 units and 256 units new ground-up construction. The Bungalow rental homes are single story built for rent homes within a gated community including Club House, Pool, Dog Wash, Dog Park and Fire…

Sector: Real Estate

Investment Size: $1 - 4.9M

UK-based medical diagnostic company with a unique screening technology for the detection of drugs using the sweat of a fingerprint. Non-invasive sample collection takes less than a minute, and results are obtained at the point of care in under…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $1 - 4.9M

QOZ Project in Los Angeles. The project is transforming a mixed use space into a destination space which includes coworking, coliving, and event space. $10M total project budget and looking for co-investors to join me.

Sector:

Investment Size: $1 - 4.9M

An entrepreneur was originally backed by Private Equity money, with the intent to buy 6-8 of the top brands in Boutique fitness (cycling, bar, palettes, yoga, rowing, etc.). Mid way through the execution of the strategy, the entrepreneur and a…

Sector:

Investment Size: $1 - 4.9M

We have built a Sports Tech Investment Platform that is a vertically integrated bridge between innovation, sports and athletes. With deep expertise, we have created investment, media, event and direct opportunities in the Sports Tech space focused…

Sector:

Investment Size: $1 - 4.9M

We are a team of experienced entrepreneurs with extensive cannabis operational expertise who are looking for investors along side us for up to $3M. We are in the process of building and integrating a full vertical in Michigan, which is one of the…

Sector:

Investment Size: $1 - 4.9M

We have invested almost $3.0M in a curent 6.0+ acre industrial/retail site in Baltimore county originally zoned BRAS (Business Roadside). The property currently has several retail tenants and a mulch manufacturer at the rear of the property and…

Sector:

Investment Size: $10 - 19.9M

Pagination

- Page 1

- Next page

Block

Network Member Discussions: FOXChat

Block

Tim Duffy

Tim Duffy