DIN Network

Block

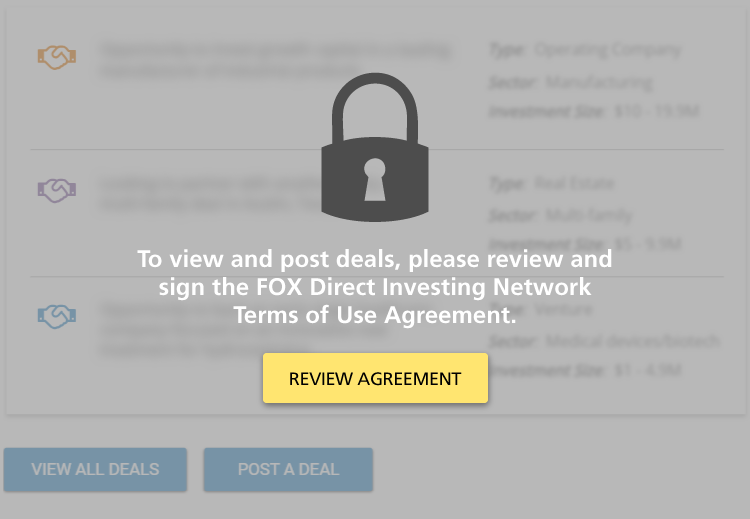

The Direct Investing Network is for families actively engaged in direct investing who want to share information, deals, and experiences with other active investors.

Terms of Use

Block

Block

DIN Network Sponsorship

Contact Tim to learn about sponsorship opportunities.

Block

Investment Deals

We have invested in Treaty Oak Brands, producers of Treaty Oak Whiskey and Waterloo Gin, headquartered on a popular ranch a few miles outside Austin, Texas, and winners of numerous international awards. The two brands are supported by the capital,…

Sector: Operating company, Food & Beverage

Investment Size: $1 - 4.9M

Inclenberg Investments is seeking LP co-investors to invest in an industrial real estate development near the Port of Houston in Pasadena, TX. Inclenberg has partnered with Provident Realty Advisors, an experienced national developer, to develop a…

Sector: Real Estate

Investment Size: $1 - 4.9M

Brixton Capital has been awarded the acquisition of the Alta Warehouse apartment complex in Phoenix, AZ for $82 million / 273K per door / $290 PSF.

Alta Warehouse is a 300-unit, 4-story, elevator-served apartment community in the…

Sector: Real Estate

Investment Size: $30 - 39.9M

We are acquiring a first-class apartment community in Lakewood, Colorado, called the Windsor (the "Property") directly from the seller in an off-market transaction. The purchase price is $125 million ($320 PSF), representing a 5.67% cap…

Sector: Real Estate

Investment Size: $1 - 4.9M

LCI Development Partners is seeking a $9MM limited partner equity investment to construct a 70-unit boutique luxury multifamily project within walking distance to local grocers, restaurants, and other area amenities.

The project is located in the…

Sector: Real Estate

Investment Size: $5 - 9.9M

Please see below SpaceX opportunity for Family Office Exchange members.

SpaceX will be running a Tender Offer at year end, which occurs every 6 months for employees. The shares are classified as common. There is no difference between Tender and…

Sector: Venture Capital

Investment Size: $50M+

We’re excited to announce that in June of 2020 we plan to launch our anchor immersive gaming and entertainment company location at Chicago’s Navy Pier. Our immersive gaming and entertainment company is a Chicago-based entertainment company…

Sector: Venture Capital

Investment Size: $5 - 9.9M

AgNovos Bioscience - A Regenerative Technology Company, Pioneering Novel Treatments for Bone Disease

We are raising up to $60mm of funding at a $300mm pre-money valuation in a Series B Preferred Stock. The goal for the company to have an IPO in late 2026. The family has invested over $200mm into this company and will be investing in the…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $50M+

We have recently executed an LOI on a platform investment for Alitus Partners. The company is largely focused on a sizable niche in the aftermarket heavy duty truck parts segment of the automotive industry. The business has grown steadily over its…

Sector:

Investment Size: $20 - 29.9M

Company is the only seed company of any scale that focuses only on 100% organic seed. Recent regulatory changes require all certified organic growers to show annual increases in organic seed usage until they reach 100%. Additionally, the organic…

Sector:

Investment Size: $1 - 4.9M

We are looking to develop a high-end resort near Yosemite National Park where our family currently maintains a significant presence. The hotel will be an iconic property near the main entrance to Yosemite and are currently going through design…

Sector:

Investment Size: $10 - 19.9M

Our company is developing a unique office tower in the West Midtown submarket of Atlanta, Georgia. The project is a $135.3MM, 14-story, 267,000 square foot “creative office” building. Centered in the heart of Atlanta’s creative and technology…

Sector:

Investment Size: $10 - 19.9M

Fast-growing, vertically-integrated producer of branded and predominantly off-season fresh and healthy blueberries for a leading global wholesaler. Blueberry demand is 15x supply with a USD 3.6bn US market size, which is expected to double in the…

Sector: Real Estate, Other

Investment Size: $30 - 39.9M

"Project Canary " is seeking its Series E financing and is raising funds for the company's Early Feasibility Study in the U.S. which has received approval from the F.D.A. The company has completed 6 cases in Europe and is…

Sector:

Investment Size: $5 - 9.9M

Rosewood Property Company (“RPC”) is pleased to present investors the opportunity to make an approximately $13.5MM equity investment for a 49% ownership interest in a national 7-property, stabilized self-storage portfolio (“Portfolio” or “Properties…

Sector:

Investment Size: $10 - 19.9M

Who We Are

Since more than 80% of US consumers identify as values-driven, social purpose is now key to brand-building and business strategy. Public Good is a digital marketing platform that provides a unique way for brands to engage their customers…

Sector: Venture Capital

Investment Size: $1 - 4.9M

WAHA Technologies (the "Company") is investing $50M in the purchase of Bitcoin Mining equipment ($1.8M tranches, 1MW equipment buildouts) and looking for families to invest along the ALDER Multi-family office. ALDER's founder and CEO, Patrick Gahan…

Sector:

Investment Size: $1 - 4.9M

55+ Retirement Communities have launched with huge fanfare and strong returns. Calamar is both and pioneer and leader in this market segment. Calamar is growing the portfolio nationally for a public exit. We are looking for shoulder to sholder…

Sector: Real Estate, Senior living

Investment Size: $0 - 0.9M

Pagination

- Previous page

- Page 2

- Next page

Block

Network Member Discussions: FOXChat

Block

Tim Duffy

Tim Duffy