DIN Network

Block

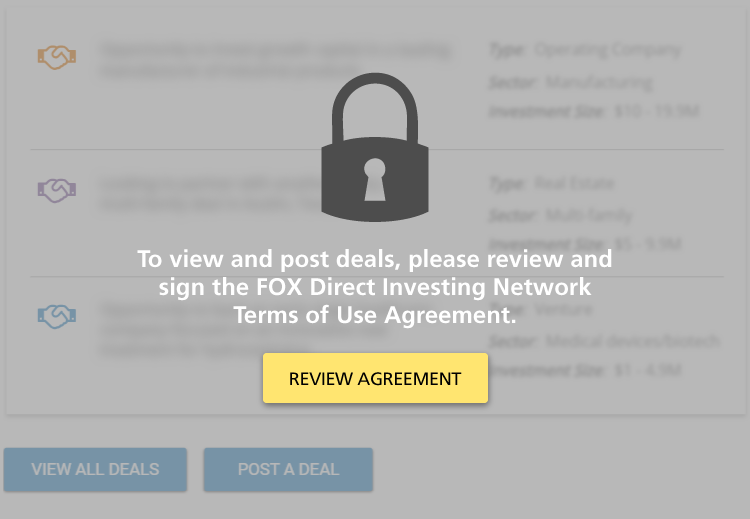

The Direct Investing Network is for families actively engaged in direct investing who want to share information, deals, and experiences with other active investors.

Terms of Use

Block

Block

DIN Network Sponsorship

Contact Tim to learn about sponsorship opportunities.

Block

Investment Deals

We have invested in Treaty Oak Brands, producers of Treaty Oak Whiskey and Waterloo Gin, headquartered on a popular ranch a few miles outside Austin, Texas, and winners of numerous international awards. The two brands are supported by the capital,…

Sector: Operating company, Food & Beverage

Investment Size: $1 - 4.9M

Inclenberg Investments is seeking LP co-investors to invest in an industrial real estate development near the Port of Houston in Pasadena, TX. Inclenberg has partnered with Provident Realty Advisors, an experienced national developer, to develop a…

Sector: Real Estate

Investment Size: $1 - 4.9M

Brixton Capital has been awarded the acquisition of the Alta Warehouse apartment complex in Phoenix, AZ for $82 million / 273K per door / $290 PSF.

Alta Warehouse is a 300-unit, 4-story, elevator-served apartment community in the…

Sector: Real Estate

Investment Size: $30 - 39.9M

We are acquiring a first-class apartment community in Lakewood, Colorado, called the Windsor (the "Property") directly from the seller in an off-market transaction. The purchase price is $125 million ($320 PSF), representing a 5.67% cap…

Sector: Real Estate

Investment Size: $1 - 4.9M

LCI Development Partners is seeking a $9MM limited partner equity investment to construct a 70-unit boutique luxury multifamily project within walking distance to local grocers, restaurants, and other area amenities.

The project is located in the…

Sector: Real Estate

Investment Size: $5 - 9.9M

Please see below SpaceX opportunity for Family Office Exchange members.

SpaceX will be running a Tender Offer at year end, which occurs every 6 months for employees. The shares are classified as common. There is no difference between Tender and…

Sector: Venture Capital

Investment Size: $50M+

We’re excited to announce that in June of 2020 we plan to launch our anchor immersive gaming and entertainment company location at Chicago’s Navy Pier. Our immersive gaming and entertainment company is a Chicago-based entertainment company…

Sector: Venture Capital

Investment Size: $5 - 9.9M

AgNovos Bioscience - A Regenerative Technology Company, Pioneering Novel Treatments for Bone Disease

We are raising up to $60mm of funding at a $300mm pre-money valuation in a Series B Preferred Stock. The goal for the company to have an IPO in late 2026. The family has invested over $200mm into this company and will be investing in the…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $50M+

Opportunity to invest up to $5 million in the $120 million Series E financing for largest global seller of air travel on mobile, with over 30 million downloads and $700 million of travel bookings. Key performance indicators are extremely compelling…

Sector: Venture Capital

Investment Size:

Seeking $2 to 17 million for investment in Series F financing of the one of the largest legalized sports betting companies in the US. The financing is being led by a prominent investment firm.

As an indirect founding investor in the…

Sector: Retail/ Consumer

Investment Size:

Our family operating business has identified a Single Family Rental real estate portfolio in Southeast Florida and is seeking co-investment from other family offices. Our company purchases newly completed construction…

Sector: Real Estate

Investment Size:

We are invested in a company utilizing blockchain technology to deliver solutions that permit the frictionless and instantaneous trading, settlement, collateralization and clearing of transactions in both traditional currencies and…

Sector: Technology

Investment Size:

We have developed an investment platform which brings sophisticated alternative investment strategies typically only used by institutional investors to retail investors in the form of liquid alternative mutual funds and ETFs. In a short…

Sector: Financial Services

Investment Size:

Our single family office is currently evaluating several technologies/deal opportunities that aim at enabling cars to perceive their environment in 3D.

Deal #1 is a series B round in a company that has a market ready & full fledged…

Sector: Venture Capital

Investment Size:

This co-investment is with a third party fund that provides equity to select developers in the cell tower space. We have a great deal of experience with the fund sponsor. Approved carrier leases are required prior to each tower…

Sector: Other

Investment Size:

We are an experienced rental housing operated based in Florida, and have been in the business since 2008. We have been recognized by Harvard Business School for our innovative and technology-driven approach in single-family home rental housing and…

Sector: Single Family

Investment Size:

Off-market value-add acquisition at a purchase price below appraised values and recent property trades in the submarket. High vacancy property with in-place rents below market value. Our wholly-owned property management company will lease-up…

Sector: Real Estate

Investment Size:

This investment is driven by a mission to create a scalable, regenerative alternative to modern industrial poultry production. The company is committed to raising broiler chickens outside on pasture and moving them to fresh grass every day…

Sector: Retail/ Consumer

Investment Size:

Pagination

- Previous page

- Page 7

- Next page

Block

Network Member Discussions: FOXChat

Block

Tim Duffy

Tim Duffy