Growing Interest in Forging a Direct Investment Path

Below is an excerpt from my article, Forging a Direct Investment Path, found in the 2019 FOX ForesightTM publication.

Family offices are forging ahead—increasing their appetite for direct investments in real estate and operating businesses—as they continue to reassess the more traditional approaches to building investment portfolios.

Family offices have typically followed the investment approach of institutional investors. For the past 20 years, this has led many family office investors to pursue a “top down,” quantitatively modeled portfolio, generally structured around asset class categories. Many family offices have focused on the “endowment model,” a manager-of-managers approach, with a high allocation to illiquid private investments. As of mid-year 2017, Yale Management (often considered the leader of the endowment approach), had a target allocation of one-half of the portfolio to managers in the illiquid private asset classes of leveraged buyouts, venture capital, real estate, and natural resources.

Particularly in the 10 years leading up to the Global Financial Crisis, many families created “institutional- type” portfolios seeking access to “top tier” alternative managers (primarily private equity and hedge funds), in the pursuit of above-market returns, and particularly for private equity, expecting to be paid a premium for accepting the locks-ups and illiquidity inherent in many of these strategies.

Family Office Exchange (FOX) research indicates that family offices are moving away from the more traditional “manager of managers” approach as they reconsider the assumptions behind their private equity portfolios, with many choosing to invest directly in real estate and operating businesses, bypassing a manager and fund structure. Like all investment trends, this one has the potential to swing too far in the wrong direction. Success for active family office investors will be determined by the willingness to commit the necessary capital, resources, and investment expertise in order to attract quality deal flow, and to select - and structure - investments with a high likelihood to generate strong returns.

Strong and Growing Interest in Direct Investing

At FOX, we have seen significant growth of interest in—and execution of—direct investments in operating businesses and real estate by FOX member families. In a 2018 FOX survey, more than 80% of respondents reported that they allocate capital directly to investments, bypassing external management, in order to get exposure on their own or through co-investment with other families.

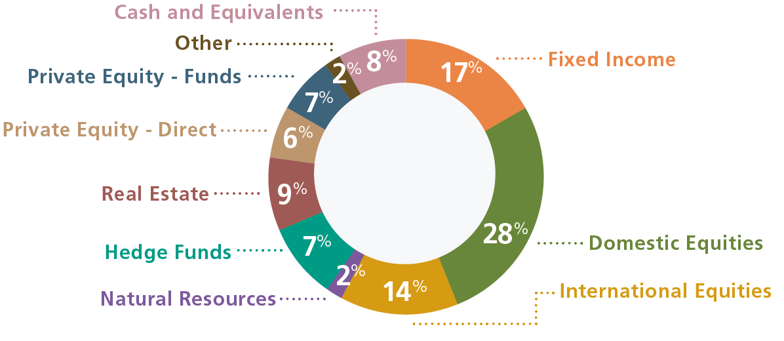

Source: 2018 FOX Global Investment Survey n=99

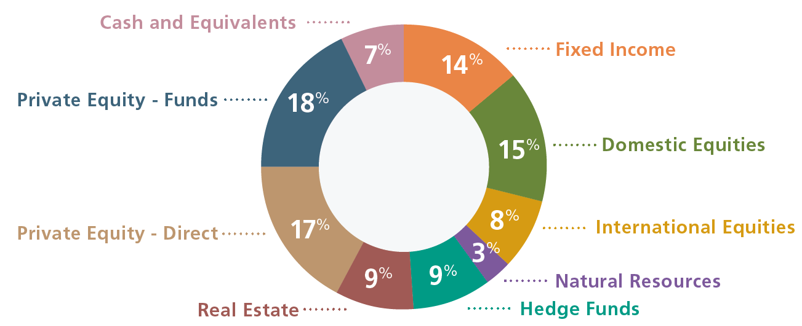

For the subset of family offices that have a significant allocation to private equity (defined as 20% or more of the portfolio), the average percentages closely match the Yale Endowment, with almost half (45%) of the portfolio allocated to illiquid private investments in private equity, real estate, and natural resources. Within the group of active private equity family offices, the allocation to direct investments in private businesses is 17%.

Source: 2018 FOX Global Investment Survey n=24

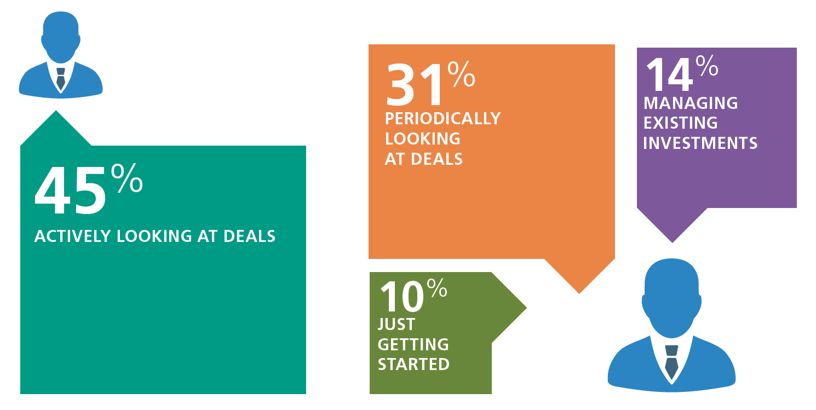

The appetite for direct investments appears to be increasing—even as family offices continue to manage the direct investments they have made. Almost 80% of FOX members surveyed said they were actively or periodically looking at deals. Of these active direct investors, family offices held an average of 15 direct investments and entered an

average of two new deals in 2017.

Source: 2018 FOX Global Investment Survey

Closing Thoughts

Family offices will continue to make direct investments in operating businesses and real estate as they forge a new investment path, based on the unique advantages of family investors. It will be interesting to watch as families chart their own way, determining when to rely on managers, and when to leverage their own experience, perspective, and flexibility by investing directly.