DIN Network

Block

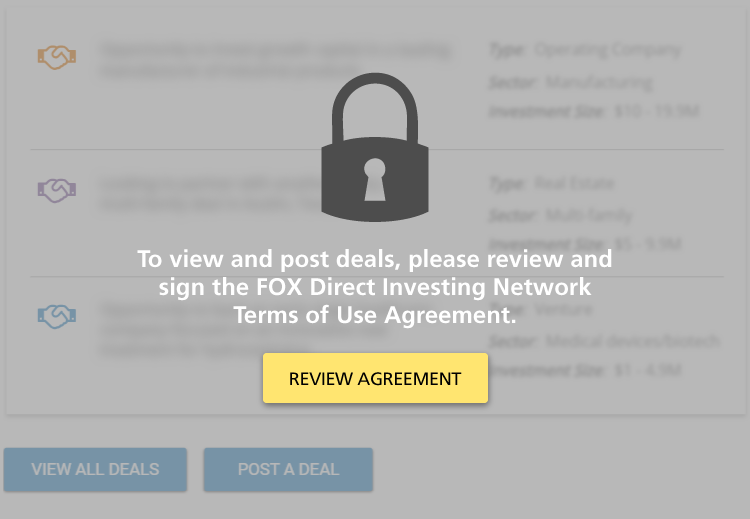

The Direct Investing Network is for families actively engaged in direct investing who want to share information, deals, and experiences with other active investors.

Terms of Use

Block

Block

DIN Network Sponsorship

Contact Tim to learn about sponsorship opportunities.

Block

Investment Deals

We have invested in Treaty Oak Brands, producers of Treaty Oak Whiskey and Waterloo Gin, headquartered on a popular ranch a few miles outside Austin, Texas, and winners of numerous international awards. The two brands are supported by the capital,…

Sector: Operating company, Food & Beverage

Investment Size: $1 - 4.9M

Inclenberg Investments is seeking LP co-investors to invest in an industrial real estate development near the Port of Houston in Pasadena, TX. Inclenberg has partnered with Provident Realty Advisors, an experienced national developer, to develop a…

Sector: Real Estate

Investment Size: $1 - 4.9M

Brixton Capital has been awarded the acquisition of the Alta Warehouse apartment complex in Phoenix, AZ for $82 million / 273K per door / $290 PSF.

Alta Warehouse is a 300-unit, 4-story, elevator-served apartment community in the…

Sector: Real Estate

Investment Size: $30 - 39.9M

We are acquiring a first-class apartment community in Lakewood, Colorado, called the Windsor (the "Property") directly from the seller in an off-market transaction. The purchase price is $125 million ($320 PSF), representing a 5.67% cap…

Sector: Real Estate

Investment Size: $1 - 4.9M

LCI Development Partners is seeking a $9MM limited partner equity investment to construct a 70-unit boutique luxury multifamily project within walking distance to local grocers, restaurants, and other area amenities.

The project is located in the…

Sector: Real Estate

Investment Size: $5 - 9.9M

Please see below SpaceX opportunity for Family Office Exchange members.

SpaceX will be running a Tender Offer at year end, which occurs every 6 months for employees. The shares are classified as common. There is no difference between Tender and…

Sector: Venture Capital

Investment Size: $50M+

We’re excited to announce that in June of 2020 we plan to launch our anchor immersive gaming and entertainment company location at Chicago’s Navy Pier. Our immersive gaming and entertainment company is a Chicago-based entertainment company…

Sector: Venture Capital

Investment Size: $5 - 9.9M

AgNovos Bioscience - A Regenerative Technology Company, Pioneering Novel Treatments for Bone Disease

We are raising up to $60mm of funding at a $300mm pre-money valuation in a Series B Preferred Stock. The goal for the company to have an IPO in late 2026. The family has invested over $200mm into this company and will be investing in the…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $50M+

Ball Ventures, LLC seeks up to $2.5MM in limited partner investment related to a 150K office building located in Meridian, Idaho.

Development is located within an exciting master-planned development which includes two recently constructed office…

Sector: Real Estate, Office Buildings

Investment Size: $1 - 4.9M

We are sponsoring and leading a $12MM preferred equity invesmtent to capitalize a best-in-class operator and developer with 57 years or experience and track record to construct a 252-unit Class-A apartment complex in the dynamic…

Sector:

Investment Size: $10 - 19.9M

The artificial intelligence market is rapidly growing and gaining attention and momentum across multiple industries. The healthcare industry in particular is in dire need of AI solutions, and it is one of the most promising areas for its application…

Sector:

Investment Size: $5 - 9.9M

OVR Technology, https://ovrtechnology.com/, is combining our most primal sense - scent - with today’s most advanced technology to make digital experiences more immersive, effective, emotional, and valuable. As the leader in digital scent…

Sector:

Investment Size: $10 - 19.9M

We are excited to announce that in 2Q 2020 we plan to break ground on a 9-acre Renewable Energy and Urban Farming Campus in South Chicago. This is a unique opportunity to invest in a highly visible and transformative project that will recycle…

Sector: Technology

Investment Size:

Opportunity to invest in Series A of student engagement and learning software that helps higher education institutions improve retention and graduation rates by tracking and learning about their students involvement patterns and behaviors. They make…

Sector: Venture Capital

Investment Size:

We are seeking 1-3 LP members to invest in a retail regional power center in Grafton, WI. The property is located approximately 20 miles north of Milwaukee directly off the 1-43 north freeway. The property is a multi-tenant retail shopping center…

Sector: Retail

Investment Size:

We’re excited to announce that in June of 2020 we plan to launch our anchor immersive gaming and entertainment company location at Chicago’s Navy Pier. Our immersive gaming and entertainment company is a Chicago-based entertainment company…

Sector: Venture Capital

Investment Size: $5 - 9.9M

Our family office has invested in a company that has created a unique and highly innovative patented technology based on biologically active materials manufactured from allogenic human blood plasma. These Plasma-based Bioactive Materials (PBMs)…

Sector: Medial Devices/ Biotech

Investment Size:

The Company was founded by a group of senior executives from global alternative asset managers and technology firms. The founders’ collective experience totals more than 100 years in senior roles at leading financial services and technology…

Sector: Technology

Investment Size:

Pagination

- Previous page

- Page 4

- Next page

Block

Network Member Discussions: FOXChat

Block

Tim Duffy

Tim Duffy