DIN Network

Block

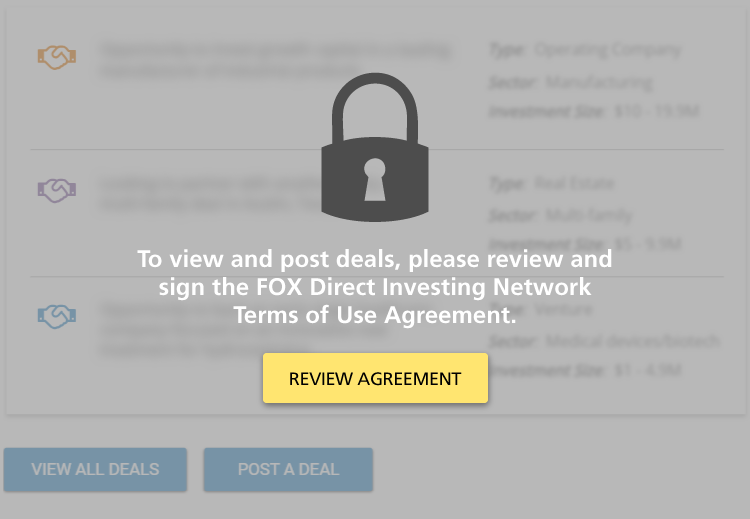

The Direct Investing Network is for families actively engaged in direct investing who want to share information, deals, and experiences with other active investors.

Terms of Use

Block

Block

DIN Network Sponsorship

Contact Tim to learn about sponsorship opportunities.

Block

Investment Deals

We have invested in Treaty Oak Brands, producers of Treaty Oak Whiskey and Waterloo Gin, headquartered on a popular ranch a few miles outside Austin, Texas, and winners of numerous international awards. The two brands are supported by the capital,…

Sector: Operating company, Food & Beverage

Investment Size: $1 - 4.9M

Inclenberg Investments is seeking LP co-investors to invest in an industrial real estate development near the Port of Houston in Pasadena, TX. Inclenberg has partnered with Provident Realty Advisors, an experienced national developer, to develop a…

Sector: Real Estate

Investment Size: $1 - 4.9M

Brixton Capital has been awarded the acquisition of the Alta Warehouse apartment complex in Phoenix, AZ for $82 million / 273K per door / $290 PSF.

Alta Warehouse is a 300-unit, 4-story, elevator-served apartment community in the…

Sector: Real Estate

Investment Size: $30 - 39.9M

We are acquiring a first-class apartment community in Lakewood, Colorado, called the Windsor (the "Property") directly from the seller in an off-market transaction. The purchase price is $125 million ($320 PSF), representing a 5.67% cap…

Sector: Real Estate

Investment Size: $1 - 4.9M

LCI Development Partners is seeking a $9MM limited partner equity investment to construct a 70-unit boutique luxury multifamily project within walking distance to local grocers, restaurants, and other area amenities.

The project is located in the…

Sector: Real Estate

Investment Size: $5 - 9.9M

Please see below SpaceX opportunity for Family Office Exchange members.

SpaceX will be running a Tender Offer at year end, which occurs every 6 months for employees. The shares are classified as common. There is no difference between Tender and…

Sector: Venture Capital

Investment Size: $50M+

We’re excited to announce that in June of 2020 we plan to launch our anchor immersive gaming and entertainment company location at Chicago’s Navy Pier. Our immersive gaming and entertainment company is a Chicago-based entertainment company…

Sector: Venture Capital

Investment Size: $5 - 9.9M

AgNovos Bioscience - A Regenerative Technology Company, Pioneering Novel Treatments for Bone Disease

We are raising up to $60mm of funding at a $300mm pre-money valuation in a Series B Preferred Stock. The goal for the company to have an IPO in late 2026. The family has invested over $200mm into this company and will be investing in the…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $50M+

This is an opportunity to invest in well-managed permanent nut crops in the Central and Sacramento Valleys of California. I worked with two families to consolidate a 14,000 acre portfolio of pistachio, walnut and almond orchards that they…

Sector: Operating company

Investment Size:

We have invested $2MM alongside the founders of the Company. We are looking to raise between $6-7MM of equity to finance the development of an anaerobic digester in Chicago, Illinois. The Chicago-based Company will provide a sustainable, green…

Sector: Energy

Investment Size:

Opportunity to invest in a profitable platform with organic growth and consolidation opportunities in the wastewater management and treatment industry.

We are acquiring a platform company which is a vertically integrated service provider in the non…

Sector: Environmental

Investment Size:

This is an investment opportunity for the purchase and improvement of a 223-unit apartment property in Oklahoma City, Oklahoma.

Sector: Multi-family

Investment Size:

Pagination

- Previous page

- Page 8

Block

Network Member Discussions: FOXChat

Block

Tim Duffy

Tim Duffy