Types of Providers

Types of Financial Service Providers

Conservative estimates suggest there are at least 12,000 firms in the U.S. competing to be the trusted advisor for wealth owners, with at least 500 targeting clients with $20-$50 million U.S. and another 100 or more firms targeting individuals with at least $50 million U.S.[1] The firms vying to serve the needs of ultra-wealthy clients encompass the full spectrum of the financial services industry. Most firms, from brokerage houses to private bankers, now have business units that serve the ultra-wealthy, and their service promises sound remarkably similar. It can be difficult for the wealth owner to distinguish between the firms that offer truly integrated wealth management services and those who have just crafted a compelling marketing message.

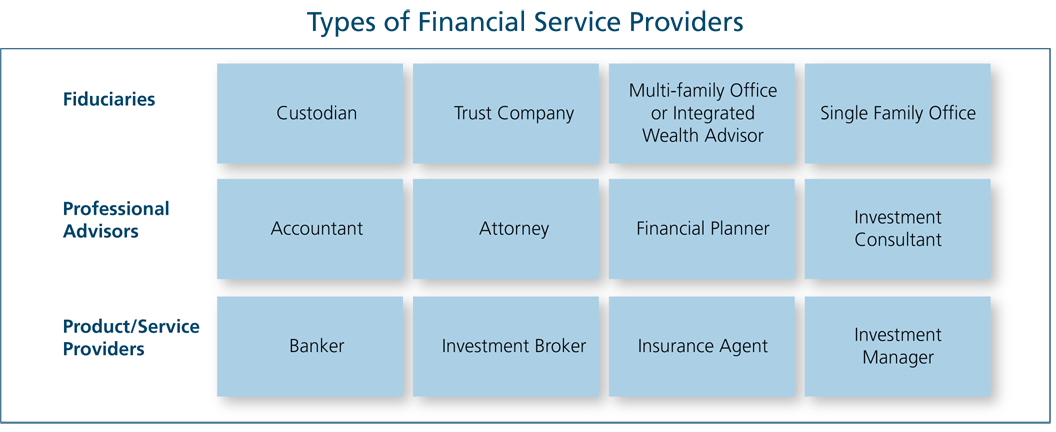

Some firms are multi-functional firms offering a variety of services, while others offer a very specific menu of products and/or services. Some are bound by fiduciary responsibilities and regulatory requirements, while others are poorly regulated or not regulated at all. One way to break through some of this confusion is to consider these organizations based on their roles and responsibilities to wealth owners. As shown in the figure above, the universe can be split into the following groups: product/service providers, professional advisors who develop plans, and fiduciaries who oversee the assets or, in some cases, the entire wealth management process. The figure identifies the types of financial service providers in each of these three groups. Each of these providers has a unique and distinctive contribution to make to the wealth management process. Sophisticated wealth owning families may use all of these resources in some capacity.

1Source: Cerulli, McKinsey & Co., and Family Office Exchange Research.