Integrated Solutions

The Case for Integrated Solutions: Finding Harmony

The music performed by a symphony orchestra under the direction of an experienced conductor is an excellent illustration of Aristotle’s principle that the whole is greater than the sum of the parts. The collaborative effort and synergy of the group results in a performance that is exponentially greater than that of a single violin or cello. Similarly, the greatest financial results occur when advisors work together to find the most advantageous way to fund an investment or consider a philanthropic initiative as an opportunity to involve the next generation while doing good in the community.

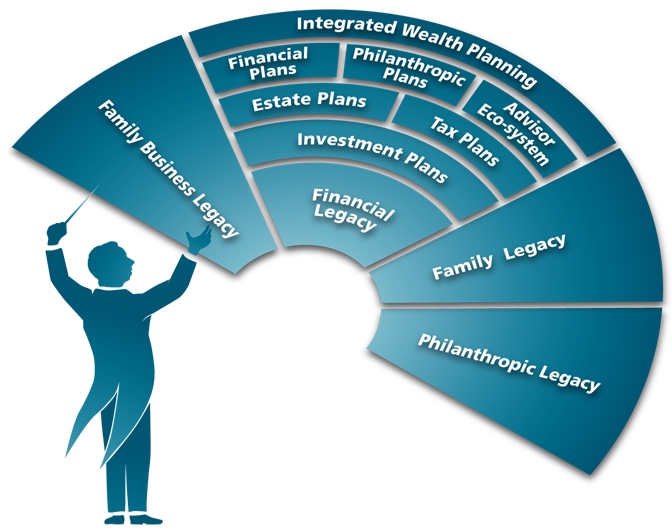

The following illustration is an adaptation of a typical symphony seating chart that identifies the instruments/disciplines in the wealth management orchestra.

Integrated Wealth Planning – The Whole Is Greater Than the Sum of Its Parts

All of these components of the process must be managed in concert to attain the best possible result.

Every owner must decide who they want to stand at the podium to lead the process:

- Self-direction – a small percentage of wealth owners have the desire, knowledge, and experience needed to manage the process on their own. They typically assemble and manage a team of external service providers.

- Dedicated single family office – wealth owners with investable assets that exceed $100 million U.S. may choose to start their own wealth management business, known as a family office, to oversee all aspects of their human and financial wealth. The sole purpose of this organization is to ensure that the goals and priorities of its owners are pursued in an independent and conflict-free manner.

- Multi-family office/integrated wealth advisor – a multi-family office (MFO) is a wealth management firm that offers integrated, highly customized services to a limited number of clients. Wealth owners who want access to the benefits of a dedicated family office (control of the process, customized solutions, confidentiality, etc.) without the overhead and responsibility of running a new business are increasingly hiring MFOs to manage the process.

Integrated wealth planning considers the impact of any financial decision on the overall wealth owner’s situation to ensure that each decision moves the owner’s goals forward. Having an inter-disciplinary team of advisors evaluating alternatives through their respective lenses (tax, fiduciary, risk management, investment, etc.) ensures better outcomes. Owners cite the following benefits of an integrated approach:

- Better and customized solutions resulting from comprehensive knowledge of the owners’ needs, legal and investment structures, and holdings

- Coordinated execution

- Cost savings resulting from elimination of duplicate processes

- Proactive process focused on the family’s goals

- Risks avoided as a result of preemptive conversations

- Time saved by streamlining communication with advisor team

Each of the advisors benefits from the process, as well. They are able to learn from the collective knowledge of the group and gain a broader understanding of the owner’s circumstances and their specific role in the process.