Family Growth

As the Family Grows, Complexity Increases

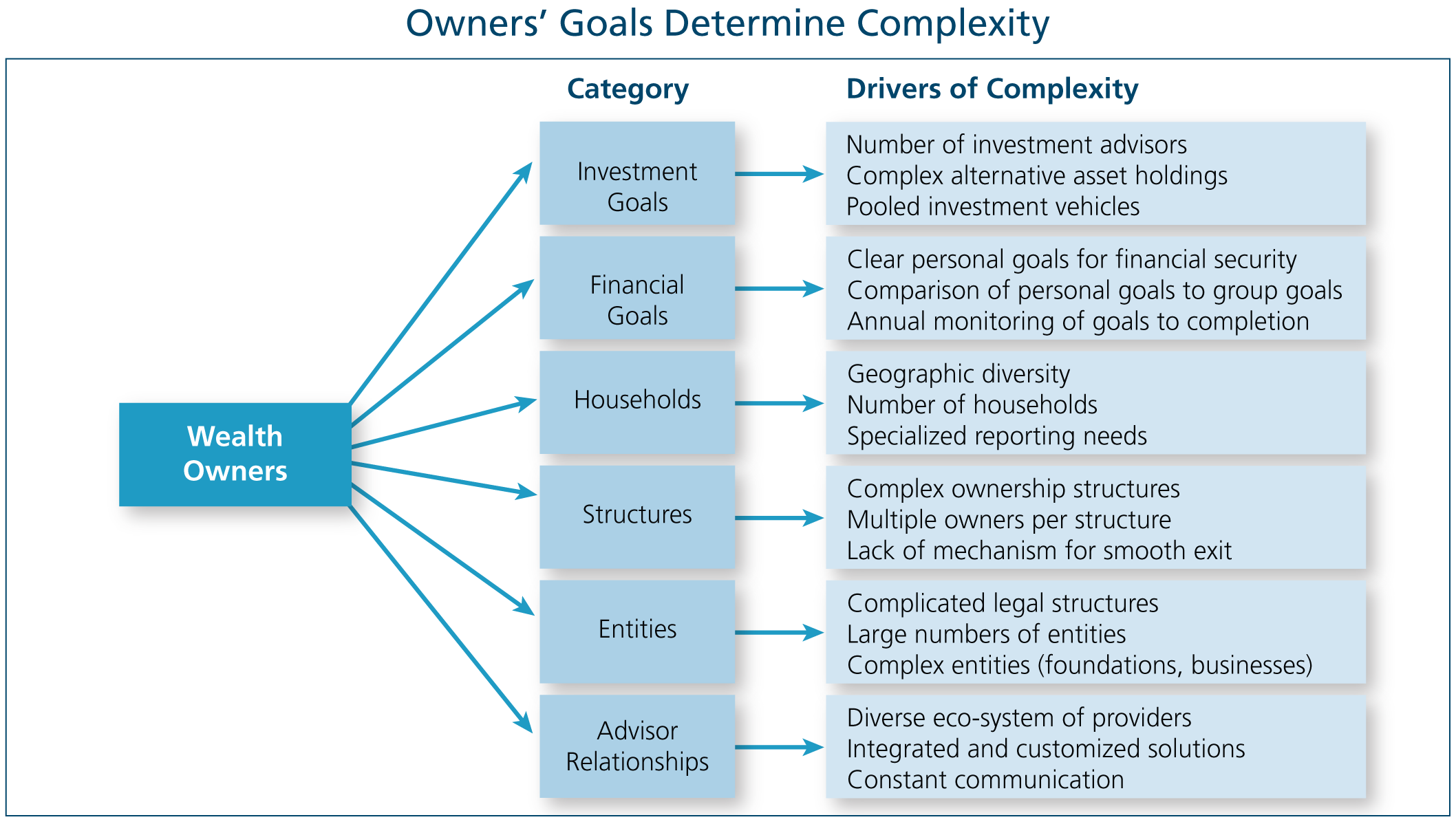

The goals and circumstances of the family group dictate the complexity of the family’s wealth management needs. A common misconception is that asset size is the most important factor in determining wealth management needs. Often more important are factors such as the number of family members or households, the nature of the ownership and legal structures, the types of investments and the entities that house them. As illustrated below, there are multiple factors driving the complexity of an individual’s situation. The central column shows a number of categories to evaluate when considering complexity, including investment goals, financial goals, households, etc. Using investment goals as an example, complexity is increased by the drivers to the right including the number of investment advisors, the addition of alternative asset holdings, and pooled investment vehicles. In general, as complexity increases, so does cost.

Coordinating all of these moving parts requires a dedicated team of advisors who understand the owners’ goals and the importance of relying on a holistic approach to achieve them. Whether you decide to start your own dedicated family office, take on the process personally and manage a team of external advisors, or rely on a wealth advisor or multi-family office to provide the benefits of a dedicated solution without the expense, integrated solutions offer the best chance for long-term success.