The Family Office Quick Guide

Below is a quick guide that can be used as an introduction if you are considering starting a family office or have recently established one. For more detailed information, browse our public resources or learn how to join the community.

What is a family office?

Families may create a family office to support their overall financial needs, after the sale of a family business or another significant liquidity event. Every family office is as unique as the family it serves.

Family offices can provide a wide range of services, including:

- Investment strategy and management

- Tax planning

- Estate planning

- Philanthropic planning

- Family education & multi-generational planning

- Lifestyle management services

When does it make sense to create a family office?

Managing family wealth successfully is a complicated undertaking, and starting a dedicated single family office is one way to manage this complexity.

Families who decide to start a family office typically have at least $100M in investable assets and want to:

- Maintain control of their assets and the decision-making process

- Preserve their privacy

- Benefit from collective buying power of the family’s combined assets

- Keep the family together

- Have a dedicated team devoted to providing key services and helping achieve long-term goals

‘Single family office’ or a ‘multi-family office‘?

Single Family Office

Wealth owners with investable assets that exceed $100 million may choose to start their own wealth management business, known as a single family office, to oversee all aspects of their human and financial wealth.

The sole purpose of this organization is to ensure that the goals and priorities of its owners are pursued in an independent and conflict-free manner.

For the purposes of this guide, the terms ‘family office’ and ‘single family office’ are used interchangeably.

Multi-Family Office

A multi-family office (MFO) is a wealth management firm that offers integrated, highly customized services to a limited number of clients. Participating families have access to a wide array of integrated services.

Individuals and families with assets greater than $20 million may be best served by a MFO. MFOs allow families to access the benefits of a dedicated single family office without the overhead and responsibility of running a new business.

How much does a family office cost?

The cost of each family office depends on a number of variables including the size of the family, the size of the staff, and nature of the family’s investments.

Complexity is the greatest predictor of cost for a family office. Getting to an “all in” cost of wealth management requires detailed consideration of the cost of the family office, the fees paid to advisory firms (e.g. accountants, attorneys, etc.) and investment costs (e.g., outsourced CIO, investment consultant, investment management fees, custody).

Average costs based on family office staff size can be found in the most recent FOX Family Office Study, developed from a comprehensive survey of over 100 family offices. The full study is available to members only; you can inquire here for access to this resource and a wealth of other insights.

Goals and complexity of the family office

A common misconception is that asset size is the most important factor in determining wealth management needs. In reality, the goals and circumstances of the family will dictate the complexity of wealth management needs.

Factors to consider include the number of family members or households, the nature of the ownership and legal structures, the types of investments, and the entities that house them.

As illustrated above, there are multiple factors driving the complexity of an individual’s situation.

Using investment goals as an example, complexity is increased by the drivers to the right, including the number of investment advisors, the addition of alternative asset holdings, and pooled investment vehicles. In general, as complexity increases, so does cost.

What are critical issues to consider in managing a family office?

Being in the wealth management business involves much more than hiring money managers to invest the proceeds of the sale. Preserving wealth requires owners to think of the wealth management process as a shared family business.

The critical aspects of family office management are illustrated in this diagram:

Managing family wealth successfully is a complex and unique undertaking for each family.

The job of the family wealth manager is to bring professionalism to the private work of growing and protecting a family’s assets for future generations. Success can be asset growth and protection, of course, but may also be measured by the peaceful transition of control from one generation to the next, or by a cohesive group of cousins collaboratively managing the founder’s philanthropic wishes.

Whatever the measures, the work of managing family wealth cannot be underestimated. Many families create a dedicated family office to have a professional way to address the challenges that financial families often encounter.

– CIO, U.S. Family Office

Finding qualified advisors who work with family offices

Advisors are key partners who provide expertise not available internally in a family office.

The average family office manages relationships with 27 different external advisors. Services most utilized by family clients are: accounting, investment planning, and integrated planning.

Interestingly, these three most utilized services are mostly provided jointly by the family office and external providers.

Selecting the right team of trusted advisors who understand your unique needs and can support your family requires careful due diligence.

The importance of a family office governing board

A governing board is known to be helpful in driving a company’s success. FOX believes a family governing board is key to the functioning of a family office and is essential to the preservation of the family enterprise.

Families of wealth and family offices did not always comprehend the role of and need for a board. However, in the past few years, there has been an increased awareness in the importance of a board as the 2017 Family Office study shows that 58% of family offices now have a governing board.

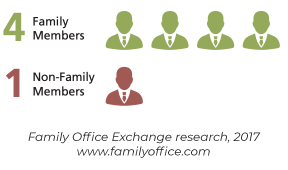

The majority of family office governing boards have an average of four family members and one non-family member. Families include independent, non-family members on their board to either provide expertise they need or to serve as an objective party supporting the execution of the family’s vision and strategy.

Read more: Family Office Practices (2018)

How are other family offices compensating their employees?

The most recent FOX Family Office Compensation & Benefits Report, based on detailed data from executives at 156 family offices, gives extensive insight into how other family offices structure and adjust their compensation packages year-over-year. Key findings from the 2018 report uncovered:

- Median salary increases for family offices have been on par with the overall market

- Even in a tight labor market, family offices have maintained a remarkably high employee retention rate

- Competitive benefits and flexible employee experience have contriubuted to these high rentention rates

How can I learn more?

FOX's website contains a wealth of knowledge compiled over 30 years. To learn more, you can start by downloading these free materials. Or, connect with one of our experts today for personalized advice and to learn how to access the FOX community and knowledge base.