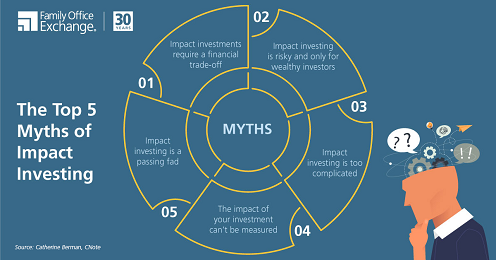

The Top 5 Myths of Impact Investing

There’s no such thing as a neutral investment. Investments either have a positive or negative impact on society. Impact investing addresses these pressing social and environmental challenges through a range of investment approaches. Impact investments can be made in both emerging and developed markets as well as across a variety of asset classes.

As part of a values-aligned investing spectrum that also includes socially responsible investing (SRI) and environmental, social, and corporate governance investing (ESG), impact investing is uniquely focused on producing a beneficial social or environmental impact alongside a financial return.

In 2018, the U.S. Forum for Sustainable and Responsible Investments estimated that around $12 trillion of assets in the U.S. are managed under some type of sustainable investment strategy. The GIIN reported that 1,720 organizations have $715 billion in impact investing assets under management as of the end of 2019.

Despite this growth, impact investing remains a widely misunderstood investment concept. Here is a breakdown of the top five myths of impact investing to dispel any confusion and help your family better understand your investment options.

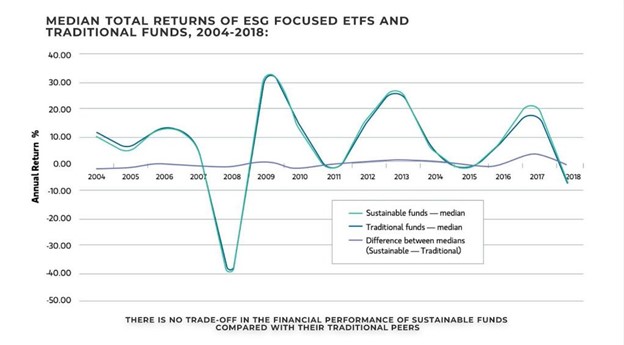

Myth #1 - Impact investments require a financial trade-off

One of the most common myths about impact investing is that it’s difficult for investors to achieve a market-rate return. The 2020 Annual Impact Investor Survey from the GIIN, JPMorgan, and the Impact Programme reveals an overwhelming majority of respondents reported meeting or exceeding both their financial and impact expectations (99 and 88 percent, respectively).

As research continues to accumulate on the benefits of supporting increased diversity in many areas of business, including corporate leadership, investors are encouraged to improve the gender and racial diversity of their portfolios for stronger returns. Certain firms are only investing in companies that include diversity in leadership such as NIA Impact Capital. NIA’s global solutions equity portfolio achieves strong returns by investing with a gender lens. Investing in community development, funding loans for female and minority entrepreneurs, affordable housing, and bringing opportunity to low-income areas through platforms like CNote is another way to add more diversity and competitive returns to your portfolio.

Myth #2 - Impact investing is risky and only for wealthy investors

According to the 2019 Nordic Investment Impact Report, institutional perceived impact investments generally have the same risk as a non-impact investment. Community development credit unions and banks are NCUA- or FDIC-insured and offer financial products with strong capitalization and flexible liquidity that address low- to moderate-income communities.

Myth #3 - Impact investing is too complicated

While it’s true that there are complex ways to make impact investments, there are simple ways as well. It can be more complicated if you don’t know the industry and don’t live in the location you’re investing in. This is a bit riskier because it requires more moving parts of expertise, diligence, and monitoring.

Some simpler methods to try out impact investing include moving your cash, applying ESG preferences to your portfolio, and SRI filtering. Your family can also start by investing in CDFI loan funds and depository institutions. The Promise Account is an FDIC-insured, 100 percent Impact Cash Account for those ready to dip their toe into the market. The Racial Justice Bond can be customized for risk and return for those who care deeply about racial justice and want to reflect that in their portfolio.

Myth #4 - The impact of your investment can’t be measured

There is an increasing emphasis on data and data collection to lend legitimacy to the market and strengthen the quality of the impact achieved. Codified and widely applied impact investing frameworks have been created to measure performance.

Some of the most common frameworks include:

IRIS and IRIS+ (Accion, TriLinc Global, Nuveen, and Troidos)

SROI Framework (KPMG and Hewlett Foundation)

SASB (Merck, BlackRock, and State Street Global Advisors)

In July 2018, the UN estimated that between $3.3-4.5 trillion per year needs to be mobilized if we hope to achieve the 2030 Agenda for Sustainable Development. As a result, Sustainable Development Goals (SDGs) have also become a galvanizing force. According to the GIIN’s 2019 annual survey, almost two-thirds of impact investment managers are currently using this framework to track their performance.

Myth #5 - Impact investing is a passing fad

Over 50 percent of active impact investing organizations made their first investment in the past decade. Investing demands are driving an increase in the number of impact investing products that have more accessible entry minimums.

Shifting wealthy dynamics also play an important role in driving demand for impact investing. Over the next 35 years, $58.7 trillion of wealth will transfer primarily to women and millennials. Over 70 percent of women show an interest in socially responsible and impact investing. Forty-five percent of millennials want to use their funds to help others and consider social responsibility a factor in making investment decisions. These numbers indicate the potential for further growth in the impact investing sector throughout the next decade and beyond.

Impact investing and the family office

Institutional and family foundations have found that they can leverage significantly greater assets to advance their core social and/or environmental goals through impact investing. There’s never been a better time to realign your family’s values with your investments.

Impact investing can help you leave a legacy of place-based investing in key passions that your family has always supported. The next generation of children and grandchildren care about the impact they’re making through their decisions. Impact investing provides an opportunity for engaging the family in discussing how to best reflect your values in your investments.