Moving from a Business Enterprise to a Family Enterprise

Date:

Jan 23, 2014

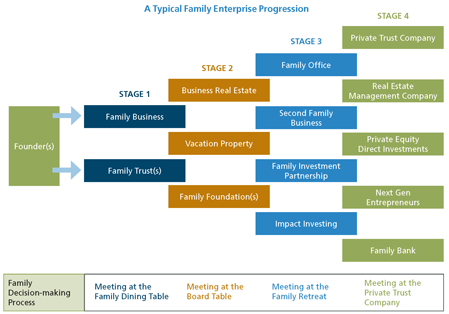

How does a family know when they are evolving from a family business into a family enterprise? When the collective activities of the family grow beyond the boundaries of the original business, there is evidence of an emerging family enterprise. The evidence appears gradually over time - when a vacation property is shared with all of the children; a foundation board is formed to manage the philanthropic goals; or a pooled investment fund is created to manage the liquid assets distributed from the original business.

There are a variety of elements that can create complexity as shown in the chart below. Before the family even realizes it, they may have more than 20 legal entities and 40+ tax returns to be overseen and managed by a trusted advisor. The way the family makes decisions together also evolves as the family enterprise gets more complex over time, and decision-making moves from 3 siblings around the dining table to 30 family members at a family retreat within a 30 year period of time.

The management of these diverse business entities also evolves gradually – managed first inside the business, and later with a trusted accountant or newly-formed family office which is asked to “get a handle on what we own.”

There are predictable stages to the development of the enterprise, but the first few stages are logical extensions of a successful business founder, and early decisions are often tax-driven. In the later stages of the evolution, the founders’ children or grandchildren begin wrestling with what to do with all of the entities, and how to make decisions when there are multiple owners with competing priorities.

The diverse priorities among siblings and cousins are what typically make the enterprise difficult to sustain across generations.

This blog post is excerpted from the new FOX white paper, "Taking the Long-Term View of the Family Enterprise," which documents the characteristics of a family enterprise and provides a framework for you to consider as you manage the transition from a business-centric family to a family-centric enterprise.