Keeping Up With the Evolving Technology Needs of Your Family Office

Increasing demands for data and the up and coming younger generation are impacting the technology needs of family offices. Many family offices are challenged to meet the growing reporting needs of family and board members. The modern conveniences of the mobile digital age are impacting businesses everywhere, especially as the younger generation is becoming more engaged.

Many family members are seeking different investment approaches that integrate personal values, sustainability, creativity and networked communities together with standard and alternative investment strategies. They also expect to be able to access information in real-time and through secure digital channels. This is causing family offices to reevaluate their technology needs.

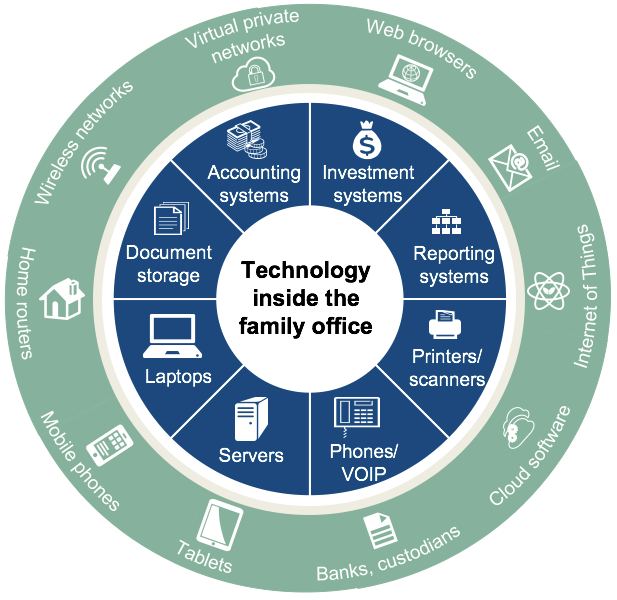

Most family offices require a combination of tools and technology, like the items shown in the graphic above. From our work with numerous family businesses and family offices across industries and regions, we are seeing growing needs in several areas. We most commonly assist family offices in assessing their needs in the five categories below:

- General Ledger – This includes accounting ledger and supporting tools (A/P, fixed assets, etc), consolidation and financial reporting.

- General Ledger “Plus” – Some families will have a need for more complex accounting functions such as investment accounting and partnership accounting. Investment accounting includes all record keeping associated with the family’s investment portfolio. Partnership accounting works to allocate the company profits to the different entities/trusts and family members.

- Aggregation and Investment Analytics – Most families have multiple custodians and financial advisors helping manage the money, which makes it difficult to get a holistic picture of the entire portfolio on a timely basis. Aggregation brings together all the different sources of a family’s investments to give a unified view of the entire portfolio. Once all the data is in one place, family offices can run analytics to provide better business intelligence around the investment portfolio, including risk and performance information.

- IT/Cloud – Most family offices lack a dedicated IT department. Basic IT infrastructure, including cloud services and cybersecurity, is needed to effectively manage the family’s operations and assets.

- Reporting – Once the data is aggregated and analytics have been applied to unlock insight, advanced reporting is the next step. Visualization tools such as interactive dashboards let family members drill down into details to answer questions and get a more in-depth view of the family’s financial condition.

Your technology components should all work together to form one holistic system that collects and processes your data, extracts meaning from that data and then provides transparency to help you take action on it. There are many options for getting the resources you need for each of these functions and more. If you choose to outsource, we can help you figure out the factors to consider and how to select the right vendor to meet your needs.

Technology is evolving rapidly and you’ll want to take an organized and disciplined approach to determining your needs and how to fulfill them with the right components. This can be a significant investment for a family and we recommend that you look 5-10 years ahead to think about how you’ll want to manage your family’s operations and finances well into the future.

For example, it’s been predicted that by 2025, robotics process automation will be as ubiquitous as spreadsheets. That’s definitely something you’ll want to factor into your thinking about technology needs. I’ll give you more information about that in our next blog post. Until then, join us at FOX Family Office Forum in July where I’ll be presenting on the key considerations for technology selection in a family office.

Danielle Valkner is a presenter at the upcoming FOX Family Office Forum, July 17-18 in Chicago. Click here for more information.