Guest Post: Why Family Businesses Need an Advocate in Washington

Family businesses in America generate 50% of the jobs, 64% of GDP and account for 61% of all privately owned businesses. While family businesses are very important to the economic growth of our country, they are not given proper consideration when new laws, regulations and restrictions are imposed by legislators and other government bodies. While most family businesses belong to an industry or trade association that advocates for that industry, the only organization that educates legislators and others who need to know about the issues that family businesses face—and that are different from public companies’—is Family Enterprise USA.

The sole mission of Family Enterprise USA (FEUSA) is to “promote family businesses in America.” The organization is dedicated to educating the public about the implications of public policy on closely held and family-owned businesses. FEUSA conducts non‐partisan research that highlights the contributions of family enterprises to the economy and the challenges these businesses face, which is then used to educate. This research provides the foundation for FEUSA to educate the public and government leaders on the important role of family businesses in the economy and local communities.

Legislators must know what is important to family businesses; what helps or hurts them when it comes to operating their business and creating more jobs. To determine those issues, Family Enterprise USA conducts a survey of family businesses each year and delivers that information to legislators, educators and others who need to know. Without this information, legislators will pass laws that could penalize family businesses, making it costlier and more difficult to operate their businesses. One example of this: tax rates that favor corporations, which pay a lower rate of tax than family owned businesses—many which operate within a Sub S Corporation, Limited Liability Company, Limited Partnership or Sole Proprietorship. Another example is the estate tax, which is paid by families but not by public companies.

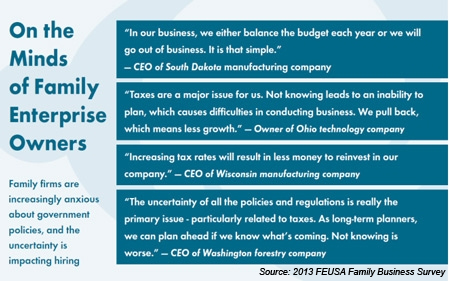

The annual survey helps us document the concerns of U.S. business owners and share them with lawmakers. Following are some of the takeaways from a recent FEUSA Family Business Survey:

FEUSA retained FOX to administer our 2016 survey. The 2016 FEUSA Family Business Survey report summarizes the responses of the 168 American family business owners who completed the survey in June and July of 2016. To read the report, click here>>

---

Disclaimer: The opinions expressed here do not necessarily represent the views of Family Office Exchange.