A Benchmark Unlike Any Other

Over the past few weeks, I have been speaking with FOX members about the Global Investment Survey, asking questions about why they participate, how they use the results, and gathering their input to inform the survey questionnaire. The information these members provided has been quite helpful, so I thought I would share their sentiments with the rest of the FOX family.

Here are some of the things they’ve had to say:

“I think, for us, it’s a good, rough benchmark. There are tons of benchmarks out there, but it’s nice to have an investment benchmark of a closely-aligned peer group of family offices.”

- Family office executive

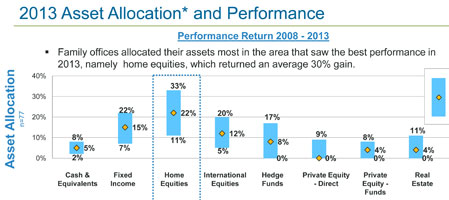

“What I find most useful is the performance information, and then somewhat distant second to that is the allocation info. The thing about family offices is they’re willing to take on the concentration and liquidity risks that others won’t.”

- Family office V.P. of investments

“We share the information with our two patriarchs. They wouldn’t necessarily go out and seek it themselves, but as we discuss things, my colleagues and I share the survey results. It really helps provide context for the owners.”

- Family office director

“We participate in order to get access to the broader information that’s only available to participants. It is another piece of the puzzle as we refine our strategy. Peer benchmarking in terms of performance, I think, is the key.”

- Family office executive

My main takeaway from these conversations has been confirmation of the value of the FOX peer community. There are plenty of investment benchmarking tools out there, but none provide the same peer perspective and hard data as the Global Investment Survey.

This year’s Global Investment Survey will launch on January 20. I strongly encourage each of you to participate, as every completed survey adds to the richness of the data we will have to share with you in March.